Types of Internal Audits

Explore the types of audits

Types of Internal Audits

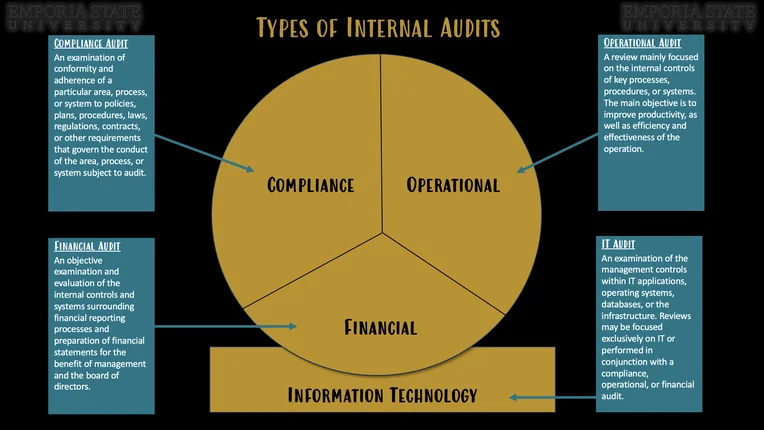

Types of Internal audits include compliance audits, operational audits, financial audits, and an information technology audits.

A compliance audit is an examination of conformity and adherence of a particular area, process, or system to policies, plans, procedures, laws, regulations, contracts, or other requirements that govern the conduct of the area, process, or system subject to audit.

An operational audit is a review mainly focused on the internal controls of key processes, procedures, or systems. The main objective is to improve productivity, as well as efficiency and effectiveness of the operation.

A financial audit is an objective examination and evaluation of the internal controls and systems surrounding financial reporting processes and preparation of financial statements for the benefit of management and the board of directors.

An information technology audit is an examination of the management controls within IT applications, operating systems, databases, or the infrastructure. Reviews may be focused exclusively on IT or performed in conjunction with a compliance, operational, or financial audit.

Comparison to External Audit

The purpose of internal audit is to analyze and improve organizational controls and performance. The purpose of external audit is to express an opinion on the organization’s financial condition and financial reporting risks.

Relationship to Accounting

“The relationship of auditing to accounting is close, yet their natures are very different; they are business associates, not parent and child. Accounting includes the collection, classification, summarization, and communication of financial data; it involves the measurement and communication of business events and conditions as they affect and represent a given enterprise or other entity. The task of accounting is to reduce a tremendous mass of detailed information to manageable and understandable proportions. Auditing does none of these things. Auditing must consider business events and conditions too, but it does not have the task of measuring or communicating them. Its task is to review the measurements and communications of accounting for propriety. Auditing is analytical, not constructive; it is critical, investigative, concerned with the basis for accounting measurements and assertions. Auditing emphasizes proof, the support for financial statements and data. Thus, auditing has its principal roots, not in accounting, which it reviews, but in logic on which it leans heavily for ideas and methods.”

Mautz, R. K., and Hussein A. Sharaf, The Philosophy of Auditing (Sarasota, FL: American Accounting Association, 1961), 14.