FAFSA Information

FAFSA Information

The Free Application for Federal Student Aid (FAFSA) is the form students must complete to be considered for financial assistance, including:

- Grants – funds that do not need to be repaid

- Loans – funds that must be repaid with interest

- Work-Study – opportunities to earn money to help pay for school

These programs are offered through the federal government. Students must submit FAFSA for each academic year they wish to receive federal aid. In addition, completing the FAFSA may be required to qualify for certain institutional or state aid programs.

Although there is no official deadline, applying early is strongly recommended to maximize your chances of receiving the most aid possible. Some federal and state programs—such as Supplemental Grants and Federal Work-Study—have limited funding. Submitting your FAFSA early ensures you are considered for the best possible aid package and that your funds are ready for fall fee payment.

ESU’s school code: 001927

FAFSA FAQ

- FAFSA OPENING DATE

The FAFSA application typically opens on October 1 for the upcoming aid year. Be sure to monitor your email and campus notifications for exact dates and updates. In addition, stay informed about other important deadlines, such as those for state programs and scholarships, to ensure you don’t miss out on any opportunities.

- WHO NEEDS FAFSA ID

Everyone who is a contributor on the FAFSA form must create a separate FSA ID and password to access and complete the online FAFSA form. Contributors who don’t have a social security number can still create a studentaid.gov account to fill out their sections on the FAFSA form. Everyone will need to go through a two-step verification process. When setting up your FSA ID, use email, text or authentication apps for added security. Watch the video below to learn more about how to create your StudentAid.gov account.

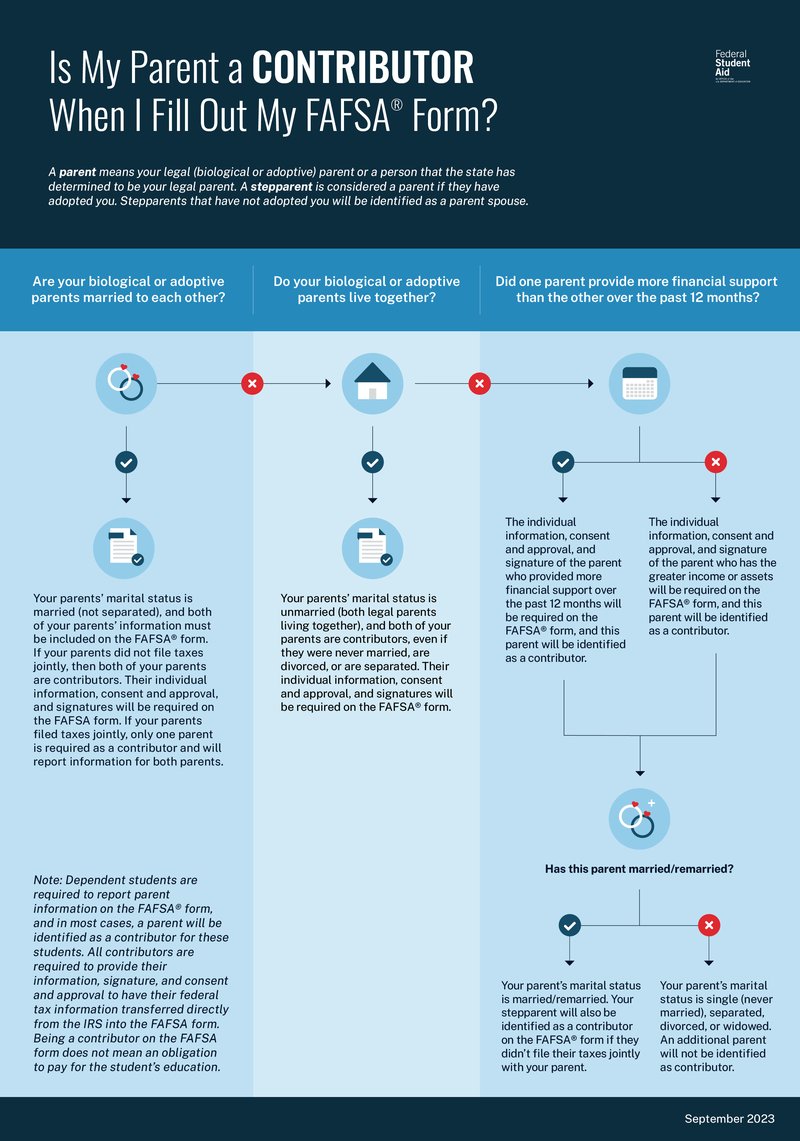

- WHO ARE MY CONTRIBUTORS

Contributor: any individual required to provide consent and approval for federal tax information (FTI) along with their signature on the FAFSA® form, including the student; the student’s spouse; a biological or adoptive parent; or the parent’s spouse (stepparent).

- MANDATORY USE OF IRS DIRECT DATA EXCHANGE

All contributors on the FAFSA must consent to the Department of Education receiving tax information or confirmation of non-filing status directly from the IRS. Consent and approval for the transfer of federal tax information are required to be eligible for federal student aid. Even if one of your contributors does not have a social security number, did not file taxes or filed taxes outside of the U.S., consent and approval are still required.

- HOW TO MAKE CORRECTIONS TO FAFSA AFTER SUBMITTING

To update your FAFSA after it has been submitted, log in to your StudentAid.gov account and locate your processed application under the “My Activity” section.

- For required corrections, choose an option listed under “Errors Found in Your Application.”

- For voluntary corrections, click the “Actions” button and select “Make a Correction.”

After making your changes, sign and submit your portion of the form. If the update involves information found in the required contributor’s section, that person must also log in, re-sign, and submit their section for the correction to be complete.

For more information about corrections go to How To Review and Correct Your FAFSA® Form | Federal Student Aid.

- REVIEWING FAFSA SUBMISSION SUMMARY

The FAFSA Submission Summary is a document that provides an overview of the information you reported on your FAFSA application. It becomes available after your form is submitted and can be accessed through your StudentAid.gov account. To view it, go to the “My Activity” section, select your processed FAFSA submission, and click “View FAFSA Submission Summary.”

If your FAFSA is complete and fully processed, the summary will display your estimated federal student aid and your Student Aid Index (SAI). If additional action is required, these estimates will not appear; instead, the summary will indicate what information is needed to determine your eligibility.

Always review your FAFSA Submission Summary carefully to ensure all details are accurate. If you find a mistake, you will need to correct your FAFSA form.

For more information about FAFSA Submission Summary go to Learn About the FAFSA Submission Summary | Federal Student Aid.